The flood of cheap capital over the past decade has seen enterprise valuations become a hotly debated topic, with companies achieving valuations that are not always representative of their capacity to generate cash flow and profitability. There is an inherent difficulty in valuing speculative, forward looking cash flows, particularly in the tech sector, where there is limited underlying performance upon which to base a valuation.

Tesla is a prime example. The company’s market capitalisation in 2019 per car delivered was $5m, compared to Volkswagen’s €8,000. Another way of looking at this is that Tesla only controls a 0.8% share of the global auto market, but its market valuation equated to 1/3 of US, EU and Japanese auto indices.

To totally labour the point, which I’m often wont to do, in 2019 Volkswagen produced and sold 11 million cars, slightly ahead of Toyota. Whereas Tesla delivered 114,000. To reach a valuation of $640bn, Tesla would have to be delivering 80 million cars priced at the rate that Volkswagen is per car delivery.

Of course, Tesla is not just a car company. The bet is on future revenue growth and Tesla’s ability to corner the nascent electric vehicle market, but this gives a good insight into how difficult and abstract valuations can be when the underlying cash flow is volatile. There have been many similar examples, where low interest rates and quantitative easing have made price discovery more difficult, or where the expectation of transformative change in the economy has made investors bullish.

VALUING A PHARMACY

When valuing a traditional business like a pharmacy there is less cause for speculative valuations, as the underlying capacity of the business to generate profits can be reliably assessed based on current performance.

A pharmacy business is typically valued by estimating how much the pharmacy could earn over a period post sale.

The main factors that affect the valuation are location, scale, how much of the business can be maintained post sale, potential future growth opportunities, adjacencies and the availability of funding.

Pharmacies are valued based on a multiple of maintainable EBITDA (Earnings Before Interest Tax Depreciation and Amortisation). While pharmacy sector valuations are essentially grounded in the discounted cash flow method, assets generally achieve multiples of between 4X and 6X.

Somewhat unusually this calculation is then adjusted for relevant net assets on completion. Relevant net assets typically include; stock, debtors, working capital cash less trade creditors, tax liabilities etc. In other comparable SME sectors, the EBITDA X Multiple calculation includes the normalised level of working capital (stock + debtors – creditors etc.), so pharmacy is a bit of an outlier.

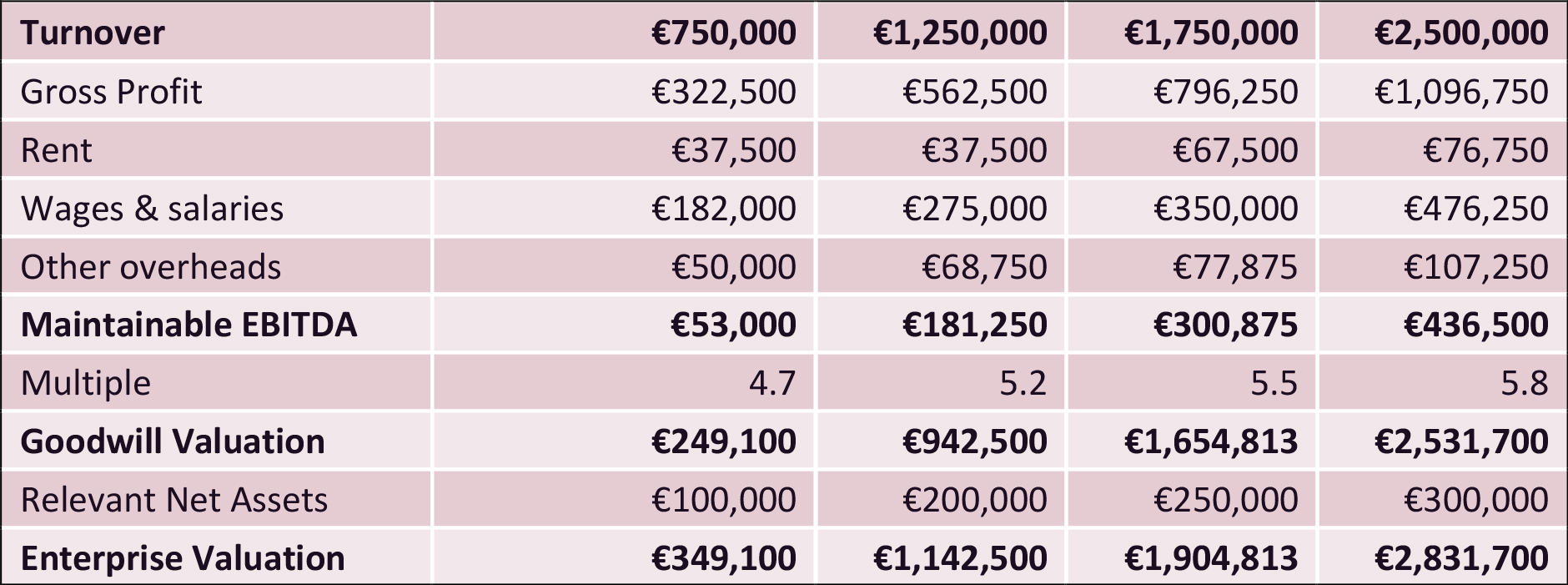

Table 1 outlines indicative valuation ranges for pharmacy businesses of differing turnover profiles. The key word here is indicative so please approach with caution as every case is unique. Stapling this blog to a set of accounts for a business in one of the turnover ranges below won’t necessarily lead to an offer at the suggested valuation!

Table 1 Valuation Models for Pharmacy Businesses of by Turnover Size

STEPS IN THE PHARMACY SALES PROCESS

The vendor should prepare the business for sale by focusing on maximising the turnover and profit potential of the business. The vendor should also identify and address all potential property and employment matters in advance of the sale.

A valuation of the business should then be undertaken by an industry expert to establish the EV range, and once this range is established the opportunity can be brought to the market. Potential acquirers are identified and approached, and those interested are provided with a non-disclosure agreement (NDA) followed by the Information Memorandum (IM).

Those who are interested in acquiring the pharmacy are invited to make an offer, accompanied with proof of funding, these offers are assessed and a preferred bidder is selected.

The preferred bidder will then carry out commercial, financial, tax and legal due diligence to ensure the information provided in the IM was accurate. Following the completion of due diligence either the initial offer price is confirmed or further negotiations occur based on the due diligence findings.

PHARMACY ACQUISITION FINANCING

While due diligence is underway the purchaser secures funding, which usually includes bank debt. If bank debt forms part of the funding package a bank appointed solicitor, paid for by the borrower, will review and opine on all legal documentation.

All active lenders in the Irish market are currently supportive of pharmacy acquisition proposals, however, applications are assessed on a case-by-case basis with consideration given to the financial profile of the borrower and the maintainable cash flow position (after debt servicing) of the target business and the borrowing entity.

As a broad benchmark bank debt typically accounts for 70% of the acquisition price, but again, every case is unique.

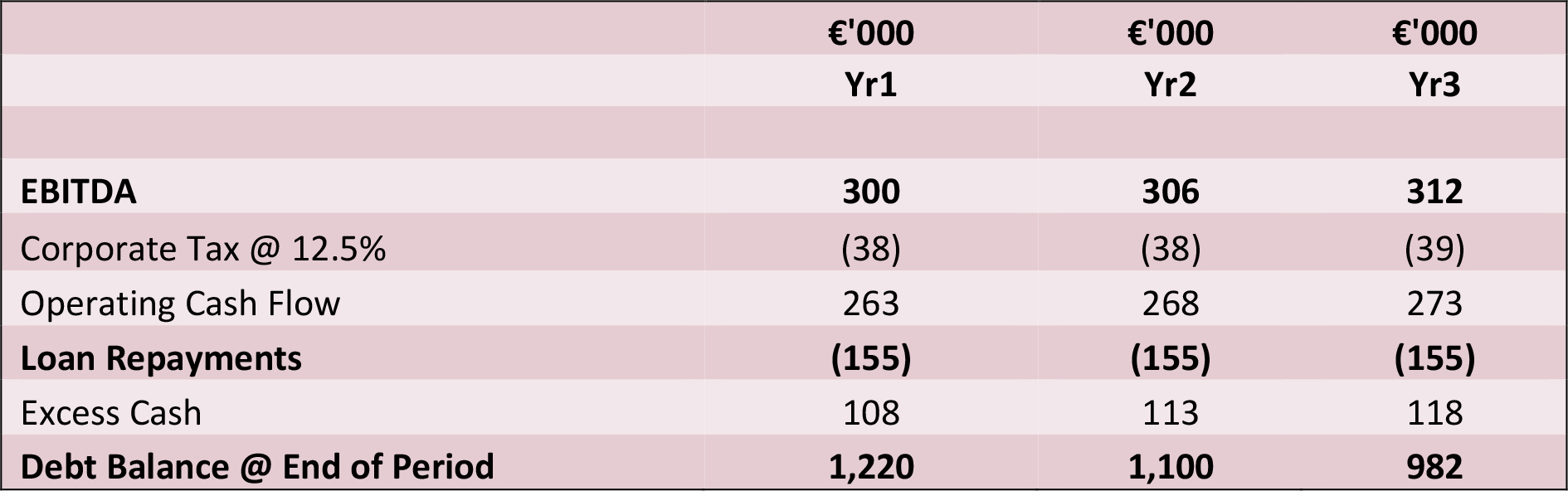

Table 2 outlines a three-year cash flow model post-sale, based on the valuation model for the pharmacy generating €1.75m in annual revenue included in Table 1.

This model is prepared under the following assumptions:

- Enterprise value of the target company is €1.9m

- Financed by 70% debt capital, 30% promotor equity

- Loan facility of 10 years at 3% interest per annum

- 2% YoY EBITDA growth

- Corporate Tax Rate of 12.5%

Table 2 Three-year cash flow Post-Transaction Model

And that’s broadly how the valuation, disposal and funding processes work, unless of course the asset is the pharmacy equivalent of Tesla in which case you should move the decimal point several places to the right!

If you would like to discuss pharmacy sector valuations, acquisitions, disposals, fundraising or any other corporate finance matter please contact Johnny O’Sullivan in our corporate finance department.