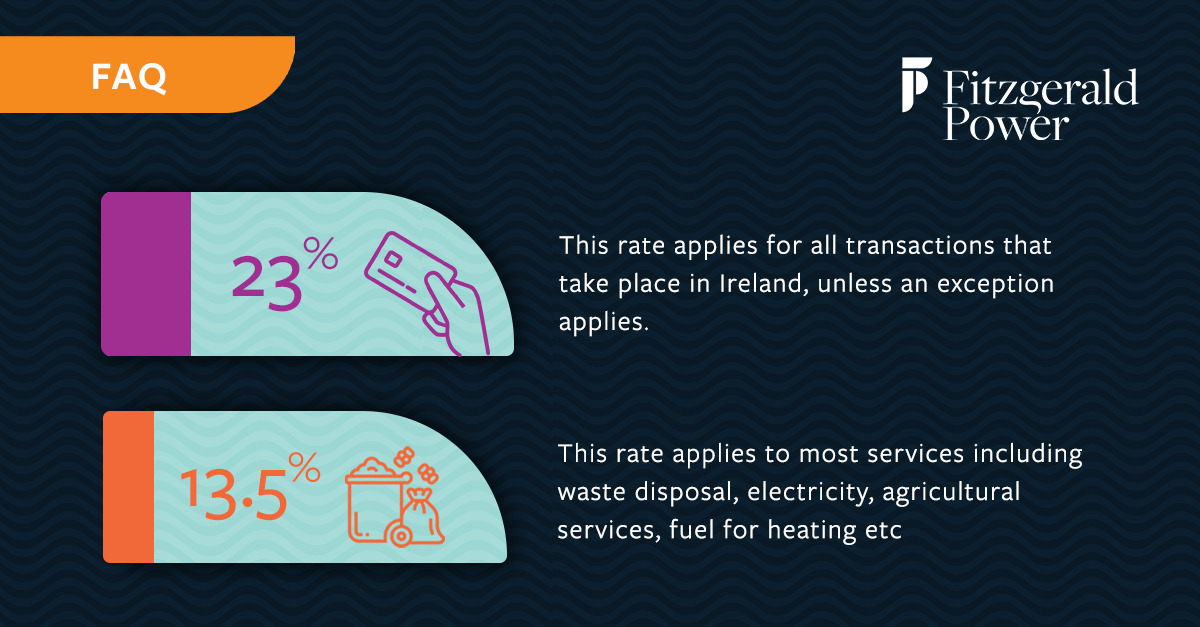

VAT is paid on most goods and services at every stage of production and distribution, so a business may need to register for VAT and charge VAT on their goods and services. Ireland has six VAT rates; zero, exempt, 4.8%, 9%, 13.5% and 23%. 23% vat rate This rate applies for all transactions that take place in Ireland, unless an exception applies (such as a reduced rate, the zero rate or an exemption, or a reason to treat the transaction as outside scope of VAT).

13.5% This rate applies to the following goods and services:

-

- Waste disposal

-

- Electricity

-

- Various agricultural services, including veterinary services

-

- Most fuel for power and heating (not diesel and petrol – standard rate applies)

-

- Holiday accommodation

-

- Restaurant and catering services

-

- Hot take-away food and hot drinks

-

- Tour guide services

-

- Certain vehicle or caravan short term hires (up to 5 weeks per annum)

-

- Repair, cleaning and maintenance services

-

- Developed immovable property

-

- Building services

-

- Works of art, antiques and literary manuscripts

-

- Driving lessons

-

- Child car seats

-

- Live plants, shrubs, flowers and certain bulbs, seeds, roots etc

-

- Admissions to cinemas, theatres, certain musical performances, museums, art gallery exhibitions

-

- Amusement services of the kind normally supplied in fairgrounds or amusement park services

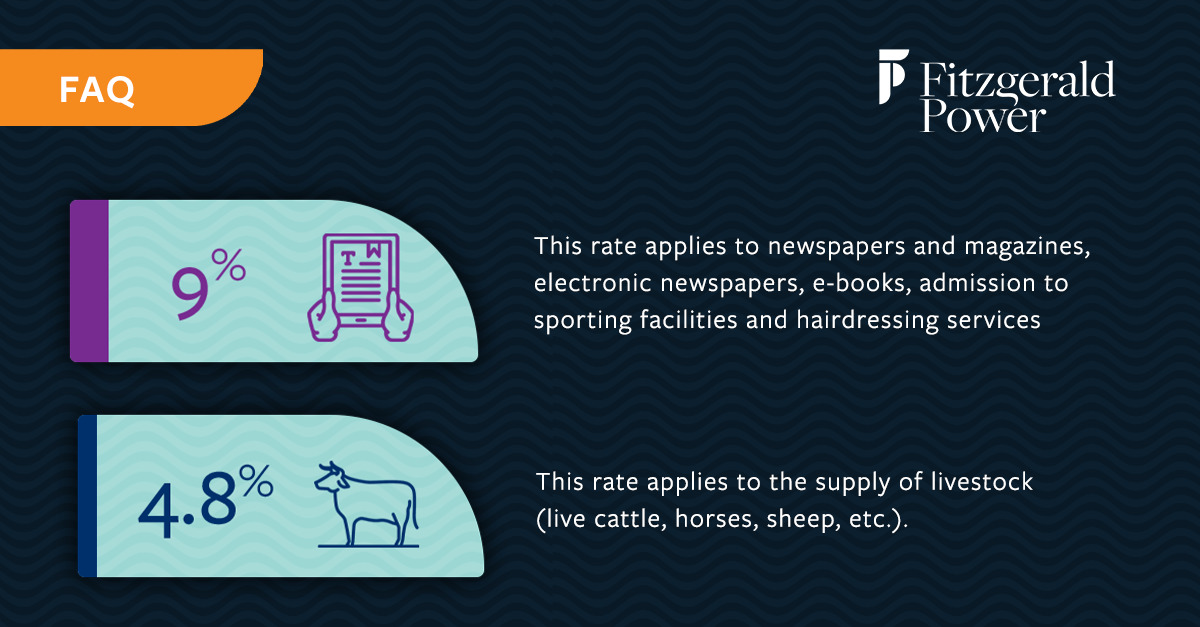

9% This rate applies to the following goods and services:

-

- Newspapers and magazines

-

- Electronic newspapers, magazines and e-books

-

- Admission to sporting facilities (the provision of facilities for taking part in sporting activities by a person other than a non-profit making organisation)

-

- Hairdressing services

4.8%

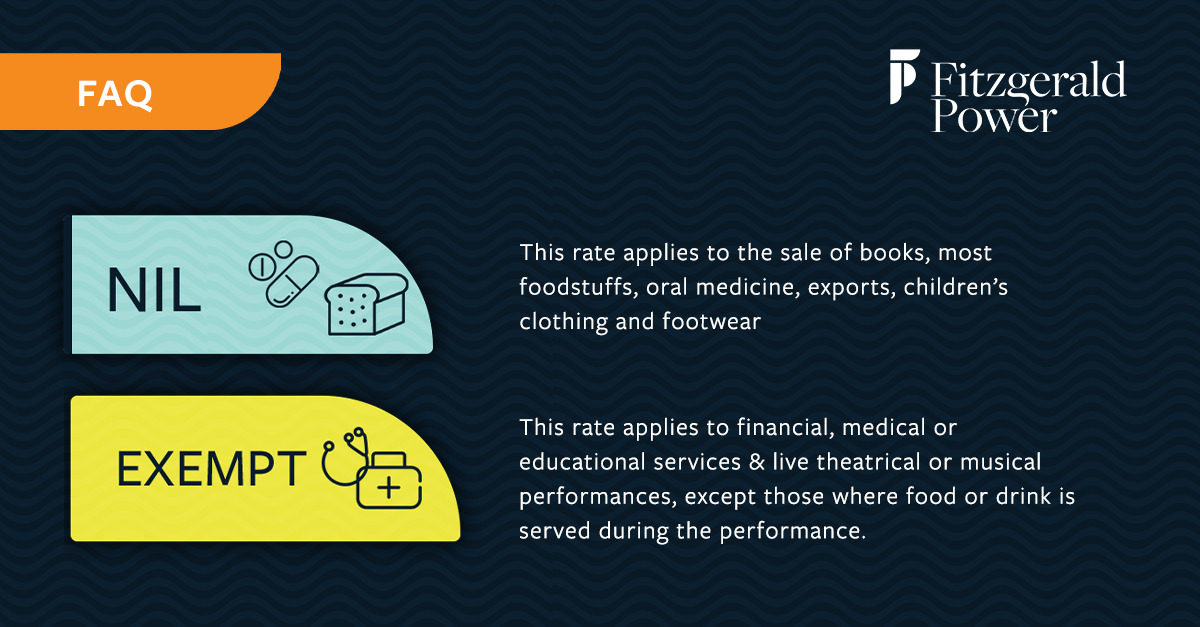

This rate applies to the supply of livestock (live cattle, horses, sheep, etc.). Nill This rate applies to the following goods and services:

-

- Books (hard copy)

-

- Most foodstuffs (excluding confectionery)

-

- Oral medicine

-

- Exports

-

- Children’s clothing and footwear

-

- Goods and services supplied to frequent exporters under the “VAT 56 Scheme”

Exempt

-

- Financial, medical or educational services.

-

- Live theatrical and musical performances except those where food or drink is served during all or part of the performance.

Vat rate change Ireland Over the period of the COVID-19 pandemic, the 13.5% and 23% rates were reduced with the aim of boosting economic activity. The standard rate of Irish VAT was decreased to 21% from 23% over a six-month period from 1 September 2020 to 28 February 2021. The 23% rate applies to most activity in Ireland and a wide range of goods and services, such automobiles, adult clothing and most basic foodstuff. The 13.5% rate was reduced to 9%. As the rates apply differentially across the economy the reductions have different sectoral impacts. The 13.5% rate applies to hospitality and tourism, and the reduction was intended to encourage activity within that sector. This cut will continue to apply until 31 December 2021, as it is seen as a key government support for the industry following the extended closures arising from COVID-19 restrictions. The tourism industry has recently suggested a further extension of the 9% VAT rate past the most recent deadline, so the deadlines might be extended. The standard rate is more common which means that it will have a broader economic impact, and also the majority of traders in Ireland had to consider the impact on their business and changes to systems when implementing the revision back to the 23% rate. Businesses will have to consider how the increase affects their pricing, both in the particulars of whether the business sets their prices inclusive of VAT, and whether the increased rates will put upward pressure on prices. Businesses may also have to change contracts that have included the previous VAT rate and need to decide how to apply the rate for transactions spanning across periods. Working out a VAT liability over time is complex, and can be affected by supply chain issues and what time of year the payment is made. There are various administrative complications as well. A business might have to capture the higher rate of VAT for any reverse charge VAT due on purchases, or if the business pays VAT to Revenue on a monthly basis the direct debit might need to be updated. The impacts are complicated both at the economy wide level and the business level, and at Fitzgerald Power we can help you think through how these changes might impact your business and how best to plan for future. Get in touch with Mary Drought in the Fitzgerald Power tax department if you have any questions.